Healthcare Staffing: Market & Software Primer

Healthcare staffing is big business.

The total US healthcare staffing market size is $23bn, growing at a 5% annual growth rate. Given the growing shortage of healthcare workers, managing staffing levels has become increasingly challenging for hospitals and other healthcare facilities.

Hospitals utilize staffing agencies to find workers to fill vacancies. Any given hospital will work with multiple of these agencies. The hospital may manage this all internally using Vendor Management Software (VMS). Alternatively, the hospital may outsource its staffing to a Managed Services Provider (MSP).

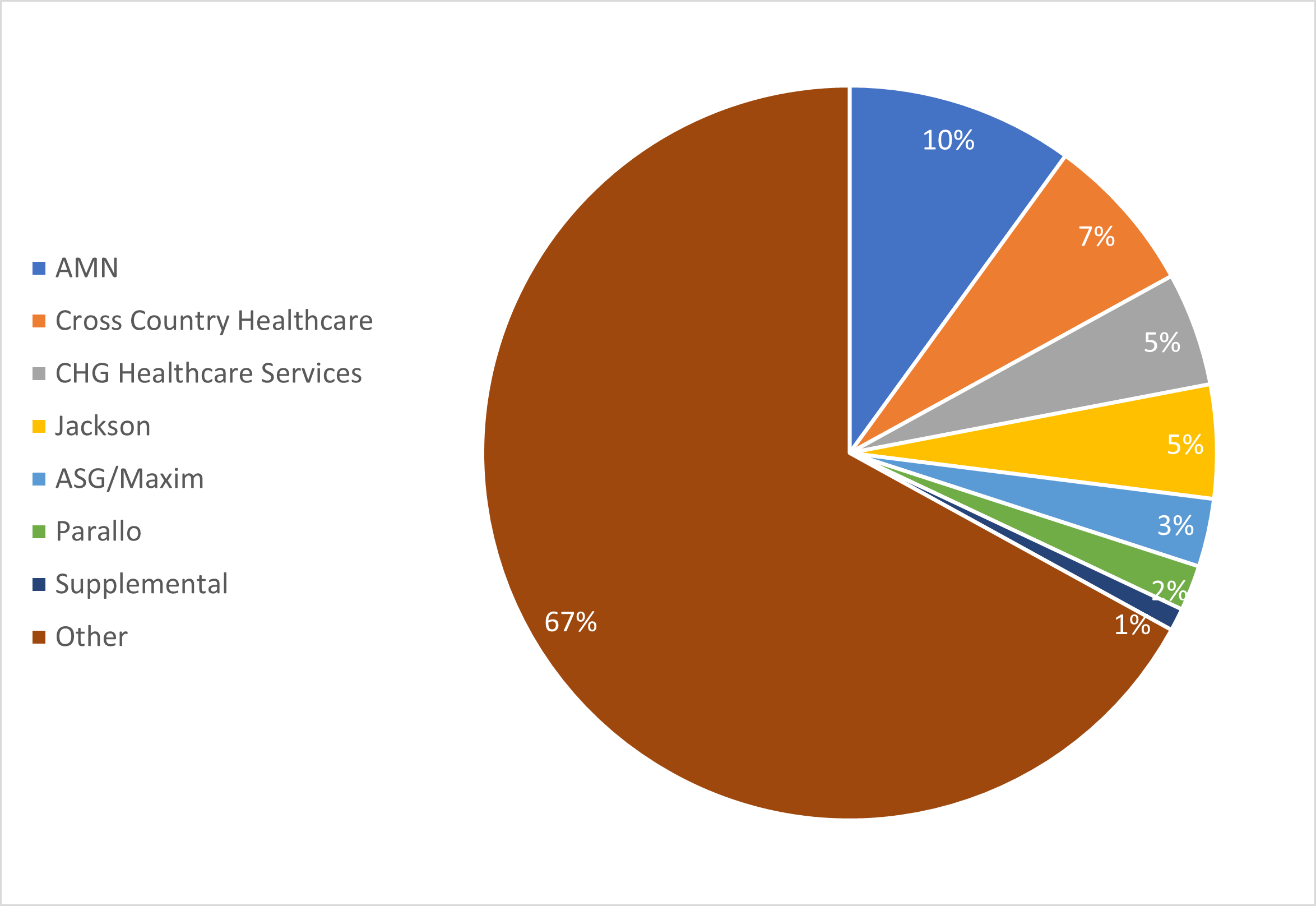

Outsourcing to MSPs has become increasingly common. Approximately 54% of all healthcare facilities are now using an MSP, and this market is growing at about 10% per year. AMN (publicly traded company) is the dominate player with 10% market share in the overall healthcare staffing industry.

There is then a very long tail of smaller players who serve the significant number of smaller hospitals and hospitals systems (95% of hospitals in the US have fewer than 3,000 beds, and the average has only 1,000). However, significant consolidation is expected over the near-term.

Over the past decade, most of the major MSPs have sought to offer their own in-house software as a point of differentiation. Many of MSPs have acquired these capabilities through acquiring smaller staffing companies. AMN acquired b4health, Medefis and ShiftWise. CHG Healthcare acquired LocumsMart. Manatal acquired Bluesky. And the list goes on. This has led to a somewhat of an odd dynamic in the MSP industry where the acquired companies continue to sell their software to other MSPs who are direct competitors to their parent MSP.